The highest rates in consulting are charged by theGlobal Strategy Consulting Firms, such as McKinsey & Company , Boston Consulting Group, Bain & Company, Strategy&, Roland Berger and A.T. Kearney.Strategy Boutiques, high-end firms that have a national/regional focus, follow in terms of rates. The conversation about rates happens with every client, sometimes more than once.

More years in the field typically mean a higher pay than what industry standards have set. When combined with your own reputation, skills, and field of expertise, your consultancy rate go up even higher. If you are more specialized in security or data analytics, there is that too. Choosing from among the available IT fields is necessary because this is how you will be able to justify your rates and decide on your fee with less hassle. This is particularly important if you are aiming to be a business development consultant.

Consulting Fees And Pricing Structure

Pricing comes down to two parties agreeing to a specific number. Yes, your lack of confidence could make it more difficult for another consultant to make a fair living. Trusted by business builders worldwide, the HubSpot Blogs are your number-one source for education and inspiration.

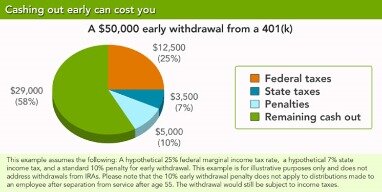

If you’re working from home, will you need office space to meet with clients? Are there any professional membership organizations that you’ll need to join up for? A higher hourly charge covers any gaps in a genuine consulting strategy. You’ll also need to include any other expenses your employer has previously paid, such as healthcare, vacation days, sick time, and a 401 plan. Multiply that by your hourly rate and then add a 10-20% markup for unexpected contingencies, and voila—you have a rough estimate for a per-project consultant rate.

Pitfalls When Deciding Consulting Rate

If you charge too little, potential clients won’t see you as a “bargain,” they will see you as an “amateur.” The average compensation range for a new undergraduate consultant at McKinsey, Boston Consulting Group, and Bain is between $108,000 to $116,000 per year. You’ve found a good starting point when calculating this rate.

- A writer by day and a peak bagger by night , you can usually find Jesse preparing for the apocalypse on a precipitous peak somewhere in the Rocky Mountains of Colorado.

- Use this information as a starting point to determine appropriate rates based on your consulting type, experience level, and industry.

- You have the expertise or a skillset that your clients need.

- The job will mostly involve looking at the current system of the client company to identify weak points.

- Nurture and grow your business with customer relationship management software.

The information provided on this publication is for general informational purposes only. For specific advice applicable to your business, please contact a professional. People have been led to believe that goods and services have an inherent value—but they don’t.

Past Consulting Fees Comparison

Instead of altogether rejecting the client , steer the client towards negotiation. Understanding what the client needs play a major role in how you https://www.globalcloudteam.com/it-consulting-rates-software-consulting-fees-rates-in-2022/ price or whether you want to move forward at all. Toss out a number too early, and it might be hard to change it later if the project evolves.

Based ondata, we can determine the compensation range of consultants from some of the top consulting firms in the U.S. A project-based consulting fee is determined by agreeing upon the project scope, analyzing the deliverables, determining the time to complete the project, and accounting for expenses. Rest assured, if you work hard, you can make a lot of money, be in total control, and work flexible hours.

Calculating Consulting Fees: Step by Step Process

TheBig Four– Deloitte, PwC, EY and KPMG – compete in the same range, but also offer lower fees in some services areas. Now that you understand some of the factors that influence https://www.globalcloudteam.com/, let’s take a look at some averages by industry. Keep in mind that these are just average hourly consulting rates.

If you feel that you have more experience and expertise than the average consultant, you can choose to charge your clients double or triple the market rate. A contract allows consultants to adopt a professional face, set expectation with their clients, and get paid. In a contract, you can lay out the scope of your work and describe payment details so all parties are satisfied throughout the course of a particular job. While you can write a contract on your own, Square has created a suite of contract templates that you can utilize for free. Once you’ve prepared a customized template, you can attach it to an invoice and send it off to your client for review. Once you’ve put together consulting fees for one client, you should be able to easily adapt the fee and fee structure for new clients.

A Closer Look at IT Consulting Fees

For example, let’s say you wanted to make a gross salary of $60,000 per year. To calculate your hourly rate, you’d divide $60,000 by 52 (which is roughly $1,154), then divide that by 40 (which is $28.85). Then, mark that up 40%, which results in an hourly rate of about $40.

If you state a number that is not acceptable for them, you will be disqualified. If you state a low salary, you will be disqualified because they will feel that you are under-skilled. It is best to dodge the question and pass it on to your client. This can cause a big issue as the nature of the projects is quite similar to each other.

What amount are people willing to pay me for my time?

And for more experienced consultants (10+ years), you’re likely in the $300+ per hour range to calculate your consulting fees. Three types of firms find themselves in the consultant revenue range between $150,000 and $220,000 per year. The Small and Mid-size Technology Players tend to have comparable rates yet vary in size, ranging from small local players to large mid-sized firms with thousands of employees. The category Mid-size Global Accountants refers to the top 20 global professional services providers, excluding the Big 4, such as BDO, Baker Tilly, Grant Thornton, RSM and PKF. Consulting firms – especially those active in the higher segments of the market – do not unveil their fee structure. Consultancies regard their rates as one of their key competitive assets and therefore manage their fee structure as a ‘trade secret’, similar to salaries, which are also shrouded in secrecy.